An Unbiased View of Special Assessment Tax Liens Florida

Table of Contents3 Easy Facts About Special Assessment Tax Liens Florida DescribedSpecial Assessment Tax Liens Florida Fundamentals ExplainedLittle Known Questions About Special Assessment Tax Liens Florida.The Ultimate Guide To Special Assessment Tax Liens FloridaThe 5-Minute Rule for Special Assessment Tax Liens FloridaSpecial Assessment Tax Liens Florida Can Be Fun For Anyone

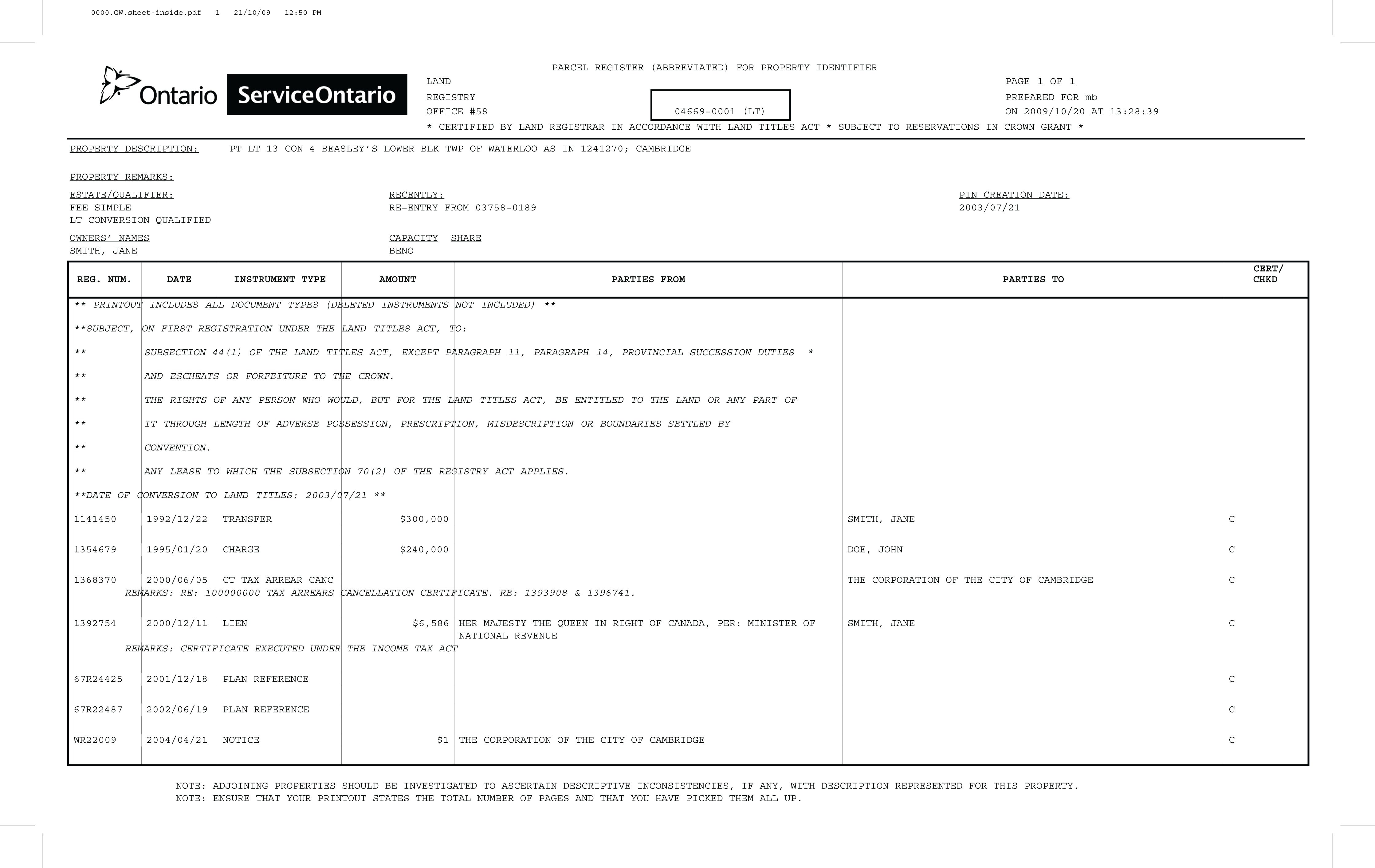

The Abstract Office, where mapping and also lawful descriptions are refined, is actually likewise housed within the Register of Deeds. Stephanie Woodworker is the Abstractor at the Ionia Area Sign Up of Acts.The Register of Actions Office is the caretaker of all files relating to the transmission or encumbrance of actual property in the area. The records are receipted, time stamped, assigned paper varieties as well as recorded through label and also residential or commercial property descriptions (special assessment tax liens florida). The reports go back to 1833 as well as any sort of one record may be gotten as well as duplicated within an issue of minutes.

Web service makes it possible for consumers to view/print straight coming from our real-time internet mark. The Abstractor can easily aid with hunts for existing as well as historic information for a fee by utilizing property summaries as well as charts to locate particular information referring to features. (Observe our Set Up of Fees below.) Search fees are actually required just before the study being actually finished, mistakes and noninclusions are not ensured through the region.

Special Assessment Tax Liens Florida Can Be Fun For Anyone

Our company are presently focusing on indexing back reports as well as have actually completed indexing back to June 1983. Our target is actually to have every document searchable and also online.

Prior to obtaining a house, you need a headline search to make sure that you can lawfully have the residential or commercial property free of cost and also definite. A title hunt entails the assessment of social reports as well as various other documents to guarantee that a building has the ability to be offered and also its label is complimentary of any type of claims, liens, or even various other issues that could imperil your capacity to legitimately have the residential property.

"This protects the financial institution."A legal representative or label provider typically does the search, which is actually most frequently launched after the dealer as well as shopper carry out an agreement. The business or even legal professional generally carries out the sleuthing at the workplace of the county or corporate staff where the building is. A lot of the essential reports are actually now available online."He or she reviews lots of sources of details pertaining to the home," including deeds, property documents, claims, separation occasions, insolvency records, and probate instances, claimed Suzanne Hollander, an attorney as well as real property teacher at Fla International Educational Institution in Miami.

The 20-Second Trick For Special Assessment Tax Liens Florida

Once all the details is compiled, the title company or even legal professional will develop a document that uncovers what has been found. Below are actually some usual issues that a title hunt mighty find, along with equivalent methods to settle all of them: Barge in the establishment of title. This problem can appear when there is a missing deed in the chain.

Special Assessment Tax Liens Florida Fundamentals Explained

Leave the package as description well as get a refund of the deposit - special assessment tax liens florida. There are actually pair of principal prices for headline companies provided through a headline business or attorney: Resolution service expenses. These feature expenses accumulated to close the funding, such as the cost of cord charges, escrow, and also financing the title insurance plan.

The cost to perform the label hunt alone often varies between $75 as well as $one hundred as well as could be paid for due to the shopper or even seller if the parties concur. Title insurance coverage costs. "Label insurance ensures the individual who is getting or even refinancing your home as the due owner of the building," Liu mentions.

"Anyone may search residential or commercial property histories through their county salesperson's workplace, as well as no rule states you can not conduct a title hunt on your own. Stitgen states, headline insurance policy will certainly not be actually issued unless the headline hunt is carried out through a professional.

Indicators on Special Assessment Tax Liens Florida You Should Know

Utilize our attribute relevant information hunt to discover whether a building is actually Torrens or intellectual along with additional property as well as income tax info. A lot of frequently taped documentations demand payment of an income tax in addition to the audio expense. View the Audio costs part of the webpage to find out recording cost and also utilize our mortgage pc registry as well as deed tax obligation calculator to figure out the amount of record or mortgage sign up tax.

Carry out not modify legal documentations along with strikeouts, series throughs, whiteout, adjustment strip, or staple extraction. Utilize our online calculator to establish the appropriate Condition Deed Income tax (SDT) amount (the tax is. 0034 of the web point to consider or acquisition cost) to feature. For values of greater than $3,000 full and provide an e, CRV (Minnesota Law 272.

A lien is actually defined as a custody on actual or private property for the complete satisfaction of personal debt or even task. The Division of Income submits a charge along with the county Prothonotary Workplace when a specific or even organization possesses unpaid try this overdue income taxes. When a claim is filed, it becomes a concern of social file.

The smart Trick of Special Assessment Tax Liens Florida That Nobody is Talking About

The team files liens for all forms of condition income taxes: company income taxes, purchases & make use of taxes, employer withholding income taxes, private income taxes, inheritance income taxes, motor gas income taxes, realty move taxes as well as a variety of other taxes. A charge is actually eliminated when the team gets confirmation that the past-due liability has actually been resolved.